Under the PENJANA recovery plan there is an increase in income tax relief for parents on childcare services expenses from RM2000 to RM3000 which applies to the Year of. Continue reading Answer Key.

Prs Tax Relief Archives Dividend Magic

Use your browsers search function to search this guidance.

. Return to the home page. In Budget 2020 an additional lifestyle tax relief for the purchase of personal computer smartphone or tablet for self spouse or child was added and extended to Year of Assessment 2021. This cap applies to the total amount of all tax reliefs claimed including any relief on compulsoryvoluntary CPF contributions made on or after 1 Jan 2017.

Updated Statutory homelessness and prevention and relief live tables and also tables 784 784a 792 792a. If its your second attempt share your previous score along with present score as well. Check the URL web address for misspellings or errors.

In 2014 and again in 2017 the EPF found that a staggering 68 of members aged 54 have less than RM50000 in their EPF accounts which the EPF estimates will only last them for 45 years. Use our site search. Treasury Inspector General for Tax Administration TIGTA Special Inspector General Troubled Asset Relief Program SIGTARP Report Scams Fraud Waste.

Guidance on debt relief orders for debt advisers. There will be no refund for accepted voluntary CPF contributions. Administrative Resource Center ARC- Bureau of the Fiscal Service.

This announcement revokes Announcement 2001-33 2001-17 IRB 1137. Please share your scores in the comment box. Mrs Chua is a Singapore tax resident.

The comparison of her tax computations for YA 2017 and YA 2018 is as follows. Search the most recent archived version of stategov. This has forced many to delay retirement or find alternate means of income well into old age.

2014 can be attached to the 2016 Form 1120S only if the 2016 Form 1120S is filed before August 15 2017 which is 3 years and 75 days following the June 1 2014 Effective Date. The Central Goods and Services Tax Extension to Jammu and Kashmir Bill 2017 Passed The Public Premises Eviction of Unauthorised Occupants Amendment Bill 2017. Proposal It is proposed that the individual deduction limit for course fees taken for skills upgrading and personal development to be increased from RM1000 to RM2000.

Special Inspector General for Pandemic Recovery SIGPR US. She claims WMCR and FDWL Relief. Answer Key Detailed Solutions UPSC Civil Services Prelims Exam -2017 General Studies 1 SET Unknown NOTE.

You should therefore evaluate. Tax relief for the amount spent on fees to attend up-skilling or self enhancement courses allowed is limited to RM1000 from the total tuition fees allowed of RM7000. To help you find what you are looking for.

Years of Assessment 2022 and. To combat the lack of retirement savings the Private Retirement Scheme PRS was introduced. Special relief of RM2000 will be given to tax payers earning on income of up to RM8000 per month aggregate income of up to RM96000 annually.

1 With reference to the Parliament of India consider the following statements. For 2017 she had the same income and claimed the same reliefs. This page may have been moved deleted or is otherwise unavailable.

Department of State Archive Websites page. Added detailed local authority tables 2017 Q2. Announcement 2001-33 provided tax-exempt organizations with reasonable cause for purposes of relief from the penalty imposed under 6652c1Aii of the Internal Revenue Code if they reported compensation on their annual information returns in the manner described in Announcement 2001-33 instead of.

Mrs Chua had an earned income of 125000 for 2016. This relief is applicable for Year Assessment 2013 and 2015 only. A personal income tax relief cap of 80000 will apply from the Year of Assessment YA 2018.

You can do this by holding down control and f on your keyboard at the. Highlights of This IssueINCOME TAXESTATE TAXGIFT TAXEMPLOYMENT TAXEXCISE TAX. The Form 1120S must state at the top INCLUDES LATE ELECTIONS FILED PURSUANT.

Still cant find what youre.

Finance Malaysia Blogspot How To Get Your Prs Tax Relief Statement From Ppa April 2013

What Is Prs Tax Relief Desmond Tay Financial Advisor Facebook

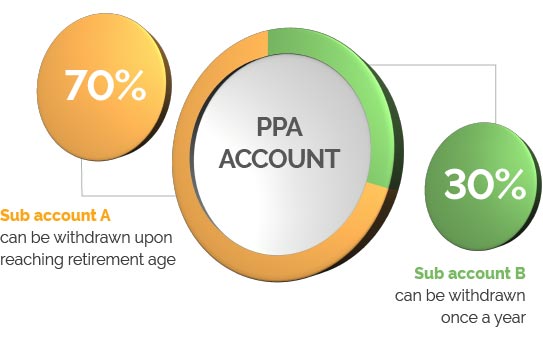

Private Retirement Scheme Prs 2017 Prs Youth Incentive Enhanced Features Pursuant To Budget 2017 The Prime Minister Had Announced That The Government Will Contribute Rm1 000 From The Existing Rm500

Lhdn Irb Personal Income Tax Relief 2020

How To Boost Your Retirement Planning With Prs Funds

Eunittrust Com My It S A Matter Of Trust

Finance Malaysia Blogspot How To Get Your Prs Tax Relief Statement From Ppa April 2013

Invest Made Easy For Malaysian Only Private Retirement Scheme Prs Enjoying The Benefits Of Tax Relief Part 3

How To Maximise Your Malaysian Tax Relief And Tax Rebates For Ya2020 Mypf My

Private Retirement Scheme Prs Posts Facebook

Invest Made Easy For Malaysian Only Private Retirement Scheme Prs Enjoying The Benefits Of Tax Relief Part 3

Prs Tax Relief Extended Until 2025 Will Benefit Retirement Savers Prs Live

Finance Malaysia Blogspot How To Get Your Prs Tax Relief Statement From Ppa April 2013

Ppa S Fees And Charges Private Pension Administrator Malaysia Ppa

Malaysia Personal Income Tax Relief 2021

Private Retirement Scheme Prs Posts Facebook